9 start with O start with O

By reading several groups of the artist's images through the lens of a sequence of critical texts, Armstrong shows how our critical and popular expectations of Degas are overturned and subverted. Each of these groups of images is matched to different interpretive moves, each highlighting distinct themes: economics and vocation; narrative and semiotics; gender and corporeality; and the author and self. Armstrong's provocative analysis celebrates the tantalizing qualities of the artist's elusive career: the pluralism of his work, its conflation of positivistic and negational tactics, the modern and the traditional, the abstract and the representational.

"A lucid and searching study. . . . Armstrong has produced one of the most elegant and persuasive examples of the historian's use of 19th-century art criticism. In the process, she has achieved a reading of the artist which makes a difference to the way we understand the difference of Degas himself."—Neil McWilliam, Times Higher Education Supplement

"This is a brilliant, original, and beautifully articulated study. Carol Armstrong's scholarship is impressive in its richness, ambition, and sophistication: Degas's works have rarely been given such detailed, penetrating, and suggestive readings as those offered in this book."—Linda Nochlin, Yale University

"With brilliant insight and incisive analytical intelligence, Carol Armstrong introduces new ways to conceptualize the structural ambiguities of Degas's work. Her subtle and probing readings clarify the fundamental contrariness of Degas's images—their disturbing negativity, their anti-modern modernism. Odd Man Out catapults the criticism of Degas from the hinterlands of traditional art history to the foreground of contemporary critical theory in both literature and the visual arts."—Charles Bernheimer, University of Pennsylvania

George W. Bush had planned to swear his oath of office with his hand on the Masonic Bible used by both his father and George Washington, however, due to the inclement weather, a family Bible was substituted. Almost immediately on taking office, President Bush made passage of "faith-based initiatives"—the government funding of religious charitable groups—a legislative priority. However, "inclement" weather storm-tossed his hopes for faith-based initiatives as well.

What happened? Why did these initiatives, which began with such vigor and support from a popular president, fail? And what does this say about the future role of religious faith in American public life? Amy Black, Douglas Koopman, and David Ryden—all prominent political scientists—utilize a framework that takes the issue through all three branches of government and analyzes it through three very specific lenses: a public policy lens, a political party lens, and a lens of religion in the public square.

Drawing on dozens of interviews with key figures in Washington, the authors tell a compelling story, revealing the evolution of the Bush faith-based strategy from his campaign for the presidency through congressional votes to the present. They show how political rhetoric, infighting, and poor communication shipwrecked Bush's efforts to fundamentally alter the way government might conduct social services. The authors demonstrate the lessons learned, and propose a more fruitful, effective way to go about such initiatives in the future.

Using rich interviews and participant observation, Patrick Ferrucci examines institutions with funding mechanisms that range from traditional mogul ownership and online-only nonprofits to staff-owned cooperatives and hedge fund control. The variations in market models have frayed the tenets of professionalization, with unique work cultures emerging from each organization’s focus on its mission and the implantation of its own processes and ethical guidelines. As a result, the field of American journalism no longer shares uniform newsgathering practices and a common identity, a break with the past that affects what information we consume today and what the press will become tomorrow.

An inside look at a fracturing profession, The Organization of Journalism illuminates the institution’s expanding impact on newsgathering and the people who practice it.

Between 1995 and 2007, financial elites in more than a dozen western European countries engaged in a cross-border battle to create some twenty new stock markets, many of which were explicitly modeled on the American Nasdaq.

The resulting high-risk, high-reward markets facilitated wealth creation, rewarded venture capitalists, and drew major U.S. financial players to Europe. But they also chipped away at the European social compacts between national governments and citizens, opening the door of smaller company finance to the broad trend of marketization and its bounties, and further subjecting European households and family businesses to the rhythms of global capital.

Elliot Posner explores the causes of Europe’s emergence as a global financial power, addressing classic and new questions about the origins of markets and their relationship to politics and bureaucracy. In doing so, he attributes the surprising large-scale transformation of Europe’s capital markets to the rise of the European Union as a global political force. The effect of Europe’s financial ascendance will have major ramifications around the world, and Posner’s analysis will push market participants, policymakers, and academics to rethink the sources of financial change in Europe and beyond.

Winner of the 2008 NJ Studies Academic Alliance author's award for an outstanding non-fiction work about New Jersey

In 1981, when Raymond Abbott was a twelve-year-old sixth-grader in Camden, New Jersey, poor city school districts like his spent 25 percent less per student than the state’s wealthy suburbs did. That year, Abbott became the lead plaintiff in a landmark class-action lawsuit demanding that the state provide equal funding for rich and poor schools. Over the next twenty-five years, as the non-profit law firm representing the plaintiffs won ruling after ruling from the New Jersey Supreme Court, Abbott dropped out of school, fought a cocaine addiction, and spent time in prison before turning his life around.

Raymond Abbott’s is just one of the many human stories that have too often been forgotten in the policy battles New Jersey has waged for two generations over equal funding for rich and poor schools. Other People’s Children, the first book to tell the story of this decades-long school funding battle, interweaves the public story—an account of legal and political wrangling over laws and money—with the private stories of the inner-city children who were named plaintiffs in the state’s two school funding lawsuits, Robinson v. Cahill and Abbott v. Burke. Although these cases have shaped New Jersey’s fiscal and political landscape since the 1970s, most recently in legislative arguments over tax reform, the debate has often been too abstract and technical for most citizens to understand. Written in an accessible style and based on dozens of interviews with lawyers, politicians, and the plaintiffs themselves, Other People’s Children crystallizes the arguments and clarifies the issues for general readers.

Beyond its implications for New Jersey, this book is an important contribution to the conversations taking place in all states about the nation’s responsibility for its poor, and the role of public schools in providing equal opportunities and promising upward mobility for hard-working citizens, regardless of race or class.

Presenting evidence that even emerging markets with strong policies and institutions experience this problem, Other People's Money recognizes that the situation must be attributed to more than ignorance. Instead, the contributors suggest that the problem is linked to the operation of international financial markets, which prevent countries from borrowing in their own currencies. A comprehensive analysis of the sources of this problem and its consequences, Other People's Money takes the study one step further, proposing a solution that would involve having the World Bank and regional development banks themselves borrow and lend in emerging market currencies.

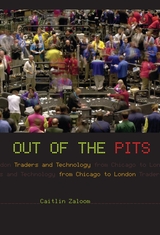

From New York to Singapore, from Chicago to London, the trading floors of the world’s financial markets are icons of global capitalism. Images of them are used on the news all the time—traders burying their heads in their hands when the market is down, their arms flailing in a frenzy when fortunes are rising—to convey the current state of the economy. But these marketplaces, and the cultural life that sustains them, are dissolving into the ether of the digital age: powerful financial institutions are shutting down the trading pits, replacing face-to-face exchanges with an electronic network where traders sit, face to screen, finger to mouse, and compete in a global arena made up of digits and charts.

Out of the Pits considers the implications of this sea change for everyone involved, from the traders and brokers to the market as a whole. Caitlin Zaloom takes us down to the floor at the Chicago Board of Trade and into a digital dealing room in the City of London. Drawing on her own firsthand experiences as a clerk and a trader and on her unusual access to these key sites of global finance, she explainshow changes at the world’s leading financial exchanges have transformed economic cultures and the craft of speculation; how people and places are responding to the digital transition; how traders are remaking themselves to compete in the contemporary marketplace; and how brokers, business managers, and software designers are collaborating to build new financial markets.

A penetrating and richly detailed account of how cities, culture, and technology shape everyday life in the new global economy, Out of the Pits will be must reading for business buffs or anyone who has ever wondered how financial markets work.

READERS

Browse our collection.

PUBLISHERS

See BiblioVault's publisher services.

STUDENT SERVICES

Files for college accessibility offices.

UChicago Accessibility Resources

home | accessibility | search | about | contact us

BiblioVault ® 2001 - 2025

The University of Chicago Press