A Five Books Best Economics Book of the Year

A Politico Great Weekend Read

“Absolutely compelling.”

—Diane Coyle

“The evolution of modern management is usually associated with good old-fashioned intelligence and ingenuity…But capitalism is not just about the free market; it was also built on the backs of slaves.”

—Forbes

The story of modern management generally looks to the factories of England and New England for its genesis. But after scouring through old accounting books, Caitlin Rosenthal discovered that Southern planter-capitalists practiced an early form of scientific management. They took meticulous notes, carefully recording daily profits and productivity, and subjected their slaves to experiments and incentive strategies comprised of rewards and brutal punishment. Challenging the traditional depiction of slavery as a barrier to innovation, Accounting for Slavery shows how elite planters turned their power over enslaved people into a productivity advantage. The result is a groundbreaking investigation of business practices in Southern and West Indian plantations and an essential contribution to our understanding of slavery’s relationship with capitalism.

“Slavery in the United States was a business. A morally reprehensible—and very profitable business…Rosenthal argues that slaveholders…were using advanced management and accounting techniques long before their northern counterparts. Techniques that are still used by businesses today.”

—Marketplace

“Rosenthal pored over hundreds of account books from U.S. and West Indian plantations…She found that their owners employed advanced accounting and management tools, including depreciation and standardized efficiency metrics.”

—Harvard Business Review

The majority of the balance sheets were created especially for this project, their components gleaned from fragmentary and heterogeneous data. There are approximately 3,500 entries, each measuring the value of one type of tangible or financial asset or liability at a given date. Goldsmith's estimates are keyed to fifteen benchmark dates in the economic progress of the cited nations, and for twelve nations he was able to construct balance sheets dating back to the nineteenth century or earlier. Combined, worldwide balance sheet are included for 1950 and 1978.

Comparative National Balance Sheets will provide an essential basis for the quantitative analysis of the long-term financial development of these nations. In addition to national balance sheets for all large countries except Brazil and China, sectoral balance sheets for France, Germany, Great Britain, India, Japan, and the United States in the postwar period are also included.

It is commonplace to say that criminals pay their debt to society by spending time in prison, but what is a “debt to society”? How is crime understood as a debt? How has time become the equivalent for crime? And how does criminal debt relate to the kind of debt held by consumers and university students?

In Debt to Society, Miranda Joseph explores modes of accounting as they are used to create, sustain, or transform social relations. Envisioning accounting broadly to include financial accounting, managerial accounting of costs and performance, and the calculation of “debts to society” owed by criminals, Joseph argues that accounting technologies have a powerful effect on social dynamics by attributing credits and debts. From sovereign bonds and securitized credit card debt to student debt and mortgages, there is no doubt that debt and accounting structure our lives.

Exploring central components of neoliberalism (and neoliberalism in crisis) from incarceration to personal finance and university management, Debt to Society exposes the uneven distribution of accountability within our society. Joseph demonstrates how ubiquitous the forces of accounting have become in shaping all aspects of our lives, proposing that we appropriate accounting and offer alternative accounts to turn the present toward a more widely shared well-being.

Presenting financial management principles and best practices applicable to both public and academic libraries, this comprehensive text elucidates a broad array of issues crucial for those entering a managerial position. Both thorough and straightforward, Sannwald's treatment

- gives readers a solid grounding in the basics of accounting and finance, with an emphasis on applicability to library management and operations;

- ties budgets and strategic planning to library vision, mission, goals, and objectives;

- discusses the roles of stakeholders such as boards, governmental/municipal bodies, the university, and the community;

- looks at a variety of funding sources, from tax revenue to gifts and donations, and presents sound strategies for including them when projecting income and expenses;

- articulates and discusses the pros and cons of various budget strategies;

- includes sample budgets and forms that can be customized as needed;

- offers expert guidance on modifying budgets for windfalls and shortfalls;

- explains operating ratios, fiscal benchmarking, and metrics, demonstrating how to use these to effectively create and manage a budget and assess the fiscal health of the library; and

- advises on how to effectively prepare and present a budget and annual financial statements to a library's governing agency.

Although introductions to courses in finance exist for a variety of fields, Robert W. Kaps provides the first text to address the subject from an aviation viewpoint. Relying on his vast experience—twenty-plus years in the airline industry and more than thirty years in aviation—Kaps seeks not only to prepare students for careers in the aviation field but also to evoke in these students an excitement about the business. Specifically, he shows students how airlines, airports, and aviation are financed. Each chapter contains examples and illustrations and ends with suggested readings and references.

Following his discussion of financial management and accounting procedures, Kaps turns to financial management and sources of financial information. Here he discusses types of business organizations, corporate goals, business ethics, maximizing share price, and sources of financial information.

Kaps also covers debt markets, financial statements, air transport sector revenue generation, and air transport operating cost management, including cost administration and labor costs, fuel, and landing fees and rentals. He describes in depth air transport yield management systems and airport financing, including revenues, ownership, operations, revenue generation, funding, allocation of Air Improvement Program funds, bonds, and passenger facility charges.

Kaps concludes with a discussion of the preparation of a business plan, which includes advice about starting and running a business. He also provides two typical business plan outlines. While the elements of fiscal management in aviation follow generally accepted accounting principles, many nuances are germane only to the airline industry. Kaps provides a basic understanding of the principles that are applicable throughout the airline industry.

Combining the latest and most extensive country-by-country generational analyses with a comprehensive review of generational accounting's innovative methodology, these papers are a consummate resource for economists, political scientists, and policy makers concerned with fiscal health and responsibility.

This volume gives trade and international economists the data and resources to renew discussion of this timely issue.

This compact and original exposition of optimal control theory and applications is designed for graduate and advanced undergraduate students in economics. It presents a new elementary yet rigorous proof of the maximum principle and a new way of applying the principle that will enable students to solve any one-dimensional problem routinely. Its unified framework illuminates many famous economic examples and models.

This work also emphasizes the connection between optimal control theory and the classical themes of capital theory. It offers a fresh approach to fundamental questions such as: What is income? How should it be measured? What is its relation to wealth?

The book will be valuable to students who want to formulate and solve dynamic allocation problems. It will also be of interest to any economist who wants to understand results of the latest research on the relationship between comprehensive income accounting and wealth or welfare.

The Inka Empire stretched over much of the length and breadth of the South American Andes, encompassed elaborately planned cities linked by a complex network of roads and messengers, and created astonishing works of architecture and artistry and a compelling mythology—all without the aid of a graphic writing system. Instead, the Inkas' records consisted of devices made of knotted and dyed strings—called khipu—on which they recorded information pertaining to the organization and history of their empire. Despite more than a century of research on these remarkable devices, the khipu remain largely undeciphered.

In this benchmark book, twelve international scholars tackle the most vexed question in khipu studies: how did the Inkas record and transmit narrative records by means of knotted strings? The authors approach the problem from a variety of angles. Several essays mine Spanish colonial sources for details about the kinds of narrative encoded in the khipu. Others look at the uses to which khipu were put before and after the Conquest, as well as their current use in some contemporary Andean communities. Still others analyze the formal characteristics of khipu and seek to explain how they encode various kinds of numerical and narrative data.

The most comprehensive and extensive study of national wealth ever attempted, The National Balance Sheet will be a rich resource for researchers and users of national accounts.

Since the United States economy accounts for almost thirty percent of the world economy, it is not surprising that accounting for this huge and diverse set of economic activities requires a decentralized statistical system. This volume outlines the major assignments among institutions that include the Bureau of Economic Analysis, the Bureau of Labor Statistics, the Department of Labor, the Census Bureau, and the Governors of the Federal Reserve System.

An important part of the motivation for the new architecture is to integrate the different components and make them consistent. This volume is the first step toward achieving that goal.

With Political Arithmetic, Nobel Prize–winning economist Robert Fogel and his collaborators tell the story of economist Simon Kuznets, the founding of the National Bureau of Economic Research, and the creation of the concept of GNP, which for the first time enabled us to measure the performance of entire economies. The book weaves together the many strands of political and economic thought and historical pressures that together created the demand for more detailed economic thinking—Progressive-era hopes for activist government, the production demands of World War I, Herbert Hoover’s interest in business cycles as President Harding’s commerce secretary, and the catastrophic economic failures of the Great Depression—and shows how, through trial and error, measurement and analysis, economists such as Kuznets rose to the occasion and in the process built a discipline whose knowledge could be put to practical use in everyday decision-making.

The product of a lifetime of studying the workings of economies and skillfully employing the tools of economics, Political Arithmetic is simultaneously a history of a key period of economic thought and a testament to the power of applied ideas.

With Political Standards, Karthik Ramanna develops the notion of “thin political markets” to describe a key problem facing technical rule-making in corporate accounting and beyond. When standard-setting boards attempt to regulate the accounting practices of corporations, they must draw on a small pool of qualified experts—but those experts almost always have strong commercial interests in the outcome. Meanwhile, standard setting rarely enjoys much attention from the general public. This absence of accountability, Ramanna argues, allows corporate managers to game the system. In the profit-maximization framework of modern capitalism, the only practicable solution is to reframe managerial norms when participating in thin political markets. Political Standards will be an essential resource for understanding how the rules of the game are set, whom they inevitably favor, and how the process can be changed for a better capitalism.

The contributors to this thoughtful volume examine the current state of prudential supervision, focusing on fundamental issues and key pragmatic concerns. Why is prudential supervision so important? What kinds of excess must it guard against? What particular forms does it take? Which of these are the most effective deterrents against mismanagement and system overload in today's rapidly shifting financial climate? The contributors foresee a continued movement beyond simple regulatory rules in banking and toward a more active evaluation and supervision of a bank's risk management practices.

Eisner counts nonmarket as well as market production, including vast amounts of services produced by housewives and others in the home, capital formation by government and households as well as business, human and intangible capital invested in education, R&D, and health care, as well as tangible capital. He offers measures of net revaluations of tangible assets, redefines the critical boundaries between final and intermediate outputs, and presents separate sector accounts for business, nonprofit institutions, government, government enterprises and households, which make clear the major contributions of nonbusiness sectors to our total national income.

For these and other extensions, Eisner's TISA offers detailed and comprehensive income and product accounts in current dollars and product accounts in constant dollars for all of the years from 1946 to 1981, along with measures of capital stocks. Estimates of consumption, investment, and production functions with the new data sets, a review of other sets of extended accounts, and a detailed description of sources and methods are also provided.

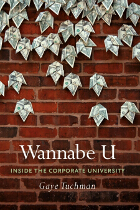

Based on years of observation at a large state university, Wannabe U tracks the dispiriting consequences of trading in traditional educational values for loyalty to the market. Aping their boardroom idols, the new corporate administrators at such universities wander from job to job and reductively view the students there as future workers in need of training. Obsessed with measurable successes, they stress auditing and accountability, which leads to policies of surveillance and control dubiously cloaked in the guise of scientific administration. In this eye-opening exposé of the modern university, Tuchman paints a candid portrait of the corporatization of higher education and its impact on students and faculty.

Like the best campus novelists, Tuchman entertains with her acidly witty observations of backstage power dynamics and faculty politics, but ultimately Wannabe U is a hard-hitting account of how higher education’s misguided pursuit of success fails us all.

READERS

Browse our collection.

PUBLISHERS

See BiblioVault's publisher services.

STUDENT SERVICES

Files for college accessibility offices.

UChicago Accessibility Resources

home | accessibility | search | about | contact us

BiblioVault ® 2001 - 2024

The University of Chicago Press